Mr Gregory Hallam (Greg) was a regulated financial advisor who worked as a representative of a number of different regulated financial companies. This meant these companies were responsible for his actions at the time he gave you advice.

He was linked to Future Financial IFA Group Ltd, Aspire Independent Financial Services Ltd, My IFA Friend, Cherish Wealth Management, & WJA Financial Services Limited or Trafalgar Square Overseas Ltd.

Greg, as he is known to his clients, ceased to be a regulated financial adviser in September 2010. This left his clients without regulatory protection to recover their losses via the Financial Ombudsman Services (FOS) or the Financial Services Compensation Scheme (FSCS) from that time onwards.

However, being unregulated didn’t stop him giving regulated advice. He used his contacts in the financial services sector to work around the regulatory rules and used his regulated contacts to arrange pension transfers and investments.

You may have signed paperwork for My IFA Friend, Cherish Wealth Management, Aspire Independent Financial Services, WJA Financial Services Limited or others without realising that you were not actually dealing with Greg Hallam or Charterhouse Asset Management.

Introductions to Charterhouse (Chester) Limited

It appears that most clients were introduced via their mortgage advice company. It makes sense because part of any financial fact find would open up a conversation about a client’s financial circumstances.

Clients may have been invited to a series of talks that referred to alternative investments. Greg Hallam, the “pension specialist”, was on hand to talk to individuals about the opportunity of using their pension funds to invest in such alternatives.

He was a “great guy” adept at ingratiating himself with people and became many people’s “close friend” over the years. The FCA fines advisors or individuals who lack honesty and integrity, individuals which ignore responsibilities and in the worst cases, seem to have no conscience.

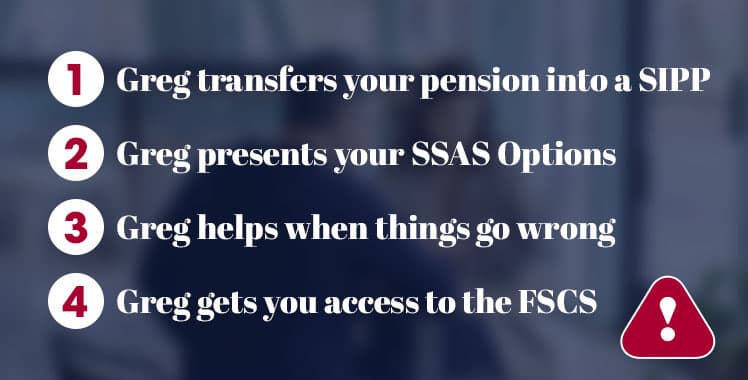

Step One: Greg transfers your pension into a SIPP

Your good friend Greg seemed to go the extra mile to find the best investment deals for you via Pointon York or the Lifetime SIPP such as:

- Accor Hotel Bond

- Avanti Property 4 LCC

- Asia Eco Plantations

- Burcote Wind Trust (Hotbed Fund Managers Limited)

- Canadia Resort Assets LP

- Caracola Beach & Spa

- Hypa Asset Management

- Interavanti Developments Investimentos Imobiliardos LDA

- Marbella Resort & Spa

- New Earth Solutions Recycling Facilities Investment Fund

- Plantation Capital

- Premier New Earth Solution Recycling Facilities Investment fund

- Residential Regeneration Limited

- SCS Farmland

- Squires Windermere Hotel Bonds

- The Mission Germany Residential Investment Fund

- Ukranian Income Developments Limited (GDCV Investments Limited)

- Venture Oil Investments Ltd

- Plantation Capital

- Pure Diamond Investments Ltd

A real friend would have explained that some of these investments were into companies of his co-director, Dennis Stephen John Riddick. He would have disclosed that he was possibly earning huge amounts in commissions for the introduction of you as a client. It would have been a requirement of a regulated financial advisor to do so.

Step Two: Greg presents your SSAS Options

Greg now recommended to some clients they close their SIPP and transfer the funds into a Small Self-Administered Schemes or SSAS.

A SSAS is a small self-administered scheme for companies – essentially a pension scheme for the directors but employees of a firm as well as family members may be able to join. However, a SSAS is a loosely regulated product and the majority of SSAS administrators are not regulated firms, so you are the only responsible party here.

Typically, a SSAS is used to invest in commercial property, to lend to your own company, to defer or get exempted from income and capital gains tax on investments or to reduce pension charges and pass the benefits of the scheme to future generations. The assets in the SSAS are ringfenced from the company and personal creditors.

The disadvantages are:

- No more than 11 members can join a SSAS;

- The members act as trustees and carry the legal responsibility and liability of running the pension. They must also ensure compliance with pension law;

- The trustees have the responsibility of handling all reporting to HMRC and arranging tax relief collection.

A SIPP on the other hand is a regulated product and its trustees have a duty to act in your best interest and ought to pay compensation when things go wrong. SIPP transactions are closely monitored by the regulatory body, the Financial Conduct Authority (FCA).

We have found that some SIPP providers didn’t agree with the transfer out to the SSAS as clients had already taken an income from their pension – they had a lucky escape.

Some of Greg’s clients are worried because they have been told their pension was moved from one SSAS into another one but they have no access to information and don’t know where their pension fund is or how to obtain annual valuations or even access their cash.

Some of Greg’s clients were introduced to Berkeley Burke, Cranfords (Cranfords Trustees Limited) and then later to asked once more to move to Retirement Capital. With each pension transfer, commissions were charged which ate into clients’ pension value.

Step Three: Greg helps when things go wrong

When clients became aware they had lost money through all this pension activity, Greg was happy to help. We have seen evidence that Greg has been working tirelessly to help them make claims against his own insurers (or so he has explained) since 2016.

He asked some clients for money in order to request information from the providers. He charged £240 payable by cheque for a process which would usually cost no more than £10.

After a number of years, when his own claims for compensation were not successful (he had lost a lot of money himself and was a joint claimant) he started working even harder.

He joined forces with Claims Management Companies (CMC’s), who are authorised and regulated to give claims advice, in order to claim compensation for clients who had seen losses on their poor investments.

The CMC’s would charge 25% plus VAT or even more on the compensation received from a successful claim. It’s possible that Greg obtained a financial benefit from introducing clients to the CMC. This is speculation but, as usual, Greg did not disclose that he had a close relationship with the directors of some of those CMC firms, that he knew them personally because they previously worked as an IFA alongside Greg.

With regards to the clients that eventually came to us, we have found that none of those CMC firms understood the claims process: They failed to progress the cases in a timely manner or told the client that the cases had simply run out of time and left them stranded for a number of years without compensation which they should have received.

Step Four: Greg gets you access to the FSCS

Greg may have offered to progress clients’ claims via the Financial Services Compensation Scheme (FSCS) on your behalf. Typically, he’d ask for payments from clients for data subject access requests (DSAR) either to the firms involved or to the FSCS. Such payments were of course to be made out to him.

To be clear, the FSCS will not request any payment from clients to carry out their data gathering work. It’s not clear what has happened regarding compensation and the many promises given by Greg that funds would be returned. A poor state of affairs for some.

Unsuitable Pension Transfer or Investment Advice

You can see from what we have written that we clearly understand what Greg has been doing. Our team possess a deep knowledge of pension and investment compensation and welcome your call to find out if you too can make a successful claim. So you’ve nothing to lose and everything to gain by calling us on 0333 358 0074.

If you had dealings with any of the firms or individuals named in this article and transferred your pension or invested money with them, you may have been given unsuitable advice. We strongly advise you should get your pension transactions reviewed by a claims expert.

This also applies to you if you have limited information or maybe don’t know where your SSAS is right now. We know how to do our job – let us get on with it and remove your worry about how to get compensation.

Get Claims Advice

Take advantage of our pension claim consulting service. We offer a free assessment of your situation to find out if you may be owed money redress or other compensation. Don’t delay because there are time limits to claim your compensation. The time to act is now!

Call us on 0333 358 0074 for an informal chat or email our compensation and claims experts at info@aclconsultancy.co.uk for a no obligation chat to explore your options and get a better understanding of how we work before deciding on the best course of action for your pension claim.

Low Fees, High Standards

If you have been cold called about a possible pension claim, had an unexpected doorstep visit or have found our website looking for a better deal, you are in good hands with us. ACL Consultancy Ltd have been in operation as a claims management company (CMC) for 10 years and have offered the lowest flat fee service in the industry since 2017.

We are able to work for a reasonable fee because we don’t buy your data from the companies involved in your claim and therefore don’t have to pay them in return. We pass these cost savings on to you. We have consistently demonstrated that high CMC fees are unjustified and don’t equate to better service or better outcomes for consumers.

Our success is your gain. We look forward to your call.